modified business tax refund

The modified business tax covers total gross wages less employee health care benefits paid by the employer. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - FINANCIAL BUSINESSES ONLY General Businesses need to use the form developed specifically for them TXR-02005.

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

To get started on the blank use the Fill camp.

:max_bytes(150000):strip_icc()/standard-deduction-3193021-FINAL-2020121-92f98d614dad4d72b36e54b867362f18.png)

. How you can complete the Nevada modified business tax return form on the web. See reviews photos directions phone numbers and more for Irs Tax Refund Schedule locations in. Taxable wages x 2 02 the tax due.

Taxpayers not having access to a Touch-tone phone can obtain tax refund information by dialing the Taxation Customer Service Center at 609-292-6400 and speaking to a taxpayer service. Modified Business Tax Return-Mining 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for businesses who are subject to the. The MBT rates have remained the same 1475 on taxable wages exceeding 50000 annually for most businesses 2 for financial institutions and mining companies and.

WASHINGTON The Internal Revenue Service today reminds taxpayers who requested an extension to file their 2021 tax return to do so by Monday October 17. Home Login Contact Phone. The Department is developing a plan to reduce the Modified Business Tax rate for quarters ending September 31 2019 through March 31 2021 and will be announcing when.

There are no changes to the threshold of the sum of all taxable. Commerce Tax Credit - Enter 50 of the Commerce Tax paid in the prior tax year up to the amount of MBT tax owed. Sign Online button or tick the preview image of the blank.

R M Business Services LTD is a full service tax accounting and business consulting firm located in East Brunswick NJ. Modified Business Tax is a self-reporting tax and you are responsible for properly characterizing your business as a Financial Institution or. Total gross wages are the total amount of all gross wages and.

See reviews photos directions phone numbers and more for Irs Tax Refund locations in Piscataway NJ. What is the modified business tax. The modified business tax covers total gross wages less employee health care benefits paid by the employer.

How Did The Tax Cuts And Jobs Act Change Business Taxes Tax Policy Center

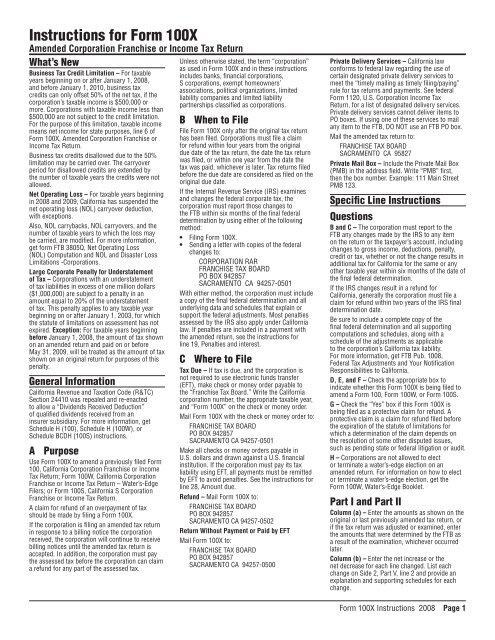

Instructions For Form 100x California Franchise Tax Board

Employers To Receive Refunds Of Overpaid Nevada Modified Business Tax Carson Valley Accounting

Income General Information Department Of Taxation

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

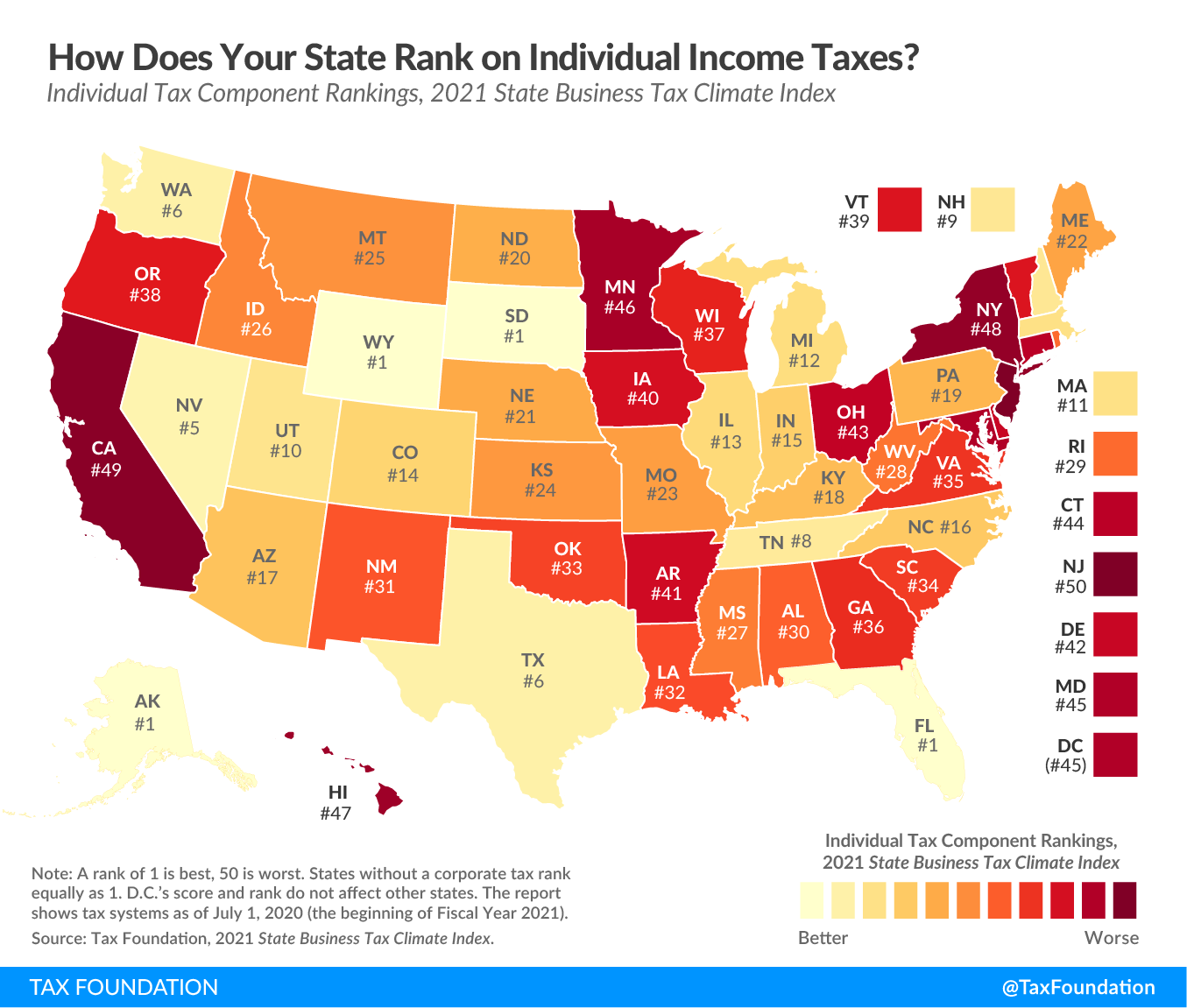

Best Worst State Income Tax Codes Tax Foundation

Bill Dentzer Dentzernews Twitter

1st Round Of Modified Business Tax Refunds Sent To Businesses In Nevada Pahrump Valley Times

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Fillable Online Modified Business Tax Return General Businesses Form Fax Email Print Pdffiller

Don T Count On That Tax Refund Yet Why It May Be Smaller This Year

Tax Implications Of The Inflation Reduction Act Commerce Trust Company

What Is Adjusted Gross Income H R Block