georgia property tax exemptions disabled

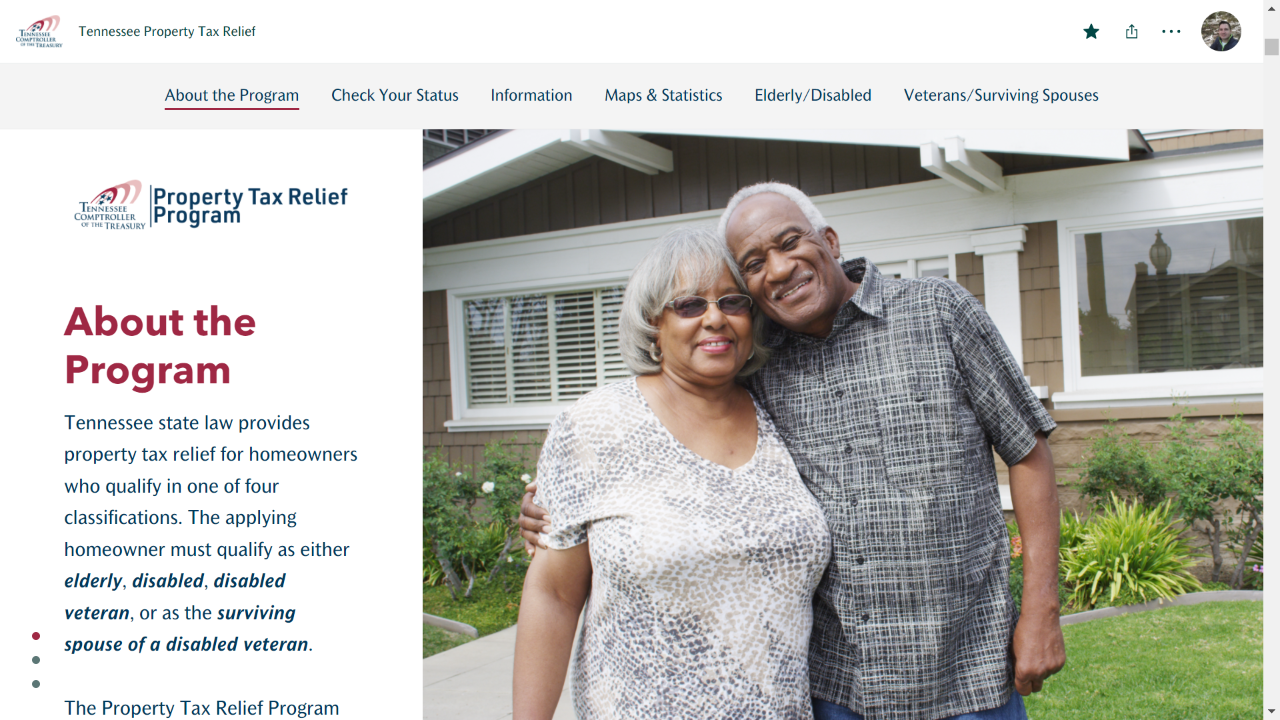

The general rule for all exemptions is. Georgia Code 48-5-41 provides an exemption from ad valorem taxes for certain properties based on the ownership and use of the property.

Fulton County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

This deduction lowers a propertys assessed value by as much as 14000 for veterans with a 100 permanent and total disability rating.

. Totally disabled veteran deduction. In addition you are automatically eligible for a. 1266 E Church Street Suite 121 Jasper GA 30143.

The 2020 Basic Homestead Exemption is worth 27360. Basic Homestead Code L1 You must own your home and reside in the. Any qualifying disabled veteran may be granted an exemption of up to 50000 plus an.

48-5-52 Any qualifying disabled veteran may be granted an exemption of 100896 from paying property taxes for state county municipal and school purposes. The only disability property tax exemption in the state is reserved for military veterans. 8 rows Individuals 62 Years of Age and Older.

Early election results show Proposition 130 appears to be passing meaning property tax exemptions could be restored for veterans with disabilities in the state. A letter from the Veterans Administration stating that the veteran has a 100 Service Connected Disability and is totally. Click here or call 706-253-8700 for Property Tax information at Pickens County Georgia government.

Georgia exempts a property owner from paying property tax on. The administration of tax exemptions is as interpreted by the tax commissioners of Georgias 159 counties. Disabled Person - 50 School Tax Exemption coded L5 or 100 School Tax Exemption coded L6 If you are 100 disabled you may qualify for a reduction in school taxes.

If a disabled Veteran has a total household income of less than 40000 and is 100 percent disabled as a result of service he or she may be eligible for a property tax exemption. A disabled veteran in Georgia may receive a property tax exemption of 60000 or more on hisher primary residence if the veteran is 100 percent disabled depending on a fluctuating index rate. S5 - 100896 From Assessed Value.

Items of personal property used in the home if not held for sale rental or other commercial. To apply for a. Disabled Veterans Homestead Exemption Fair Market Value 150000 Assessed Value Fair Market Value times 40 60000 Total Millage Rate 6160 plus 15120 plus 0250 2153.

12 hours agoThe Arizona ballot initiative that would allow property tax exemptions for veterans with disabilities widows and widowers is ahead with 64 voter approval as of Tuesday night. The only disabled property tax exemption in the state of Georgia is reserved for veterans. Up to 25 cash back Senior Citizen Exemptions From Georgia Property Tax If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a.

GDVS personnel will assist veterans in obtaining the necessary documentation for. The exemption offers a 1320 reduction of property taxes for veterans who are 100. For more information on tax exemptions visit dorgeorgiagov call 404-724-7000 contact your county tax.

Individuals who are 62 or older and live in a school district. This is a 10000 exemption in the county general and school general tax categories. The value of the property in excess of this exemption remains taxable.

Other Personal Property Exemptions. 140 HENRY PARKWAY MCDONOUGH GA 30253 164 BURKE STREET STOCKBRIDGE GA 30281 770-288-8180 opt.

Exemption Summary Richmond County Tax Commissioners Ga

Towns County Tax Assessor S Office

Specialty And Disabled Tags Newton County Tax Commissioner

Virginia Property Tax Exemption For Elderly And Disabled Question 1 2010 Ballotpedia

The Georgia Homestead Exemption Decoded Brian M Douglas

Exemptions To Property Taxes Pickens County Georgia Government

Property Tax Exemption For Disabled Veterans Offers Free Property Taxes

Georgia Property Tax Liens Breyer Home Buyers

States With Property Tax Exemptions For Veterans R Veterans

5 Property Tax Deductions In Georgia For You Excalibur

Henry County Homestead Exemption Fill Out Sign Online Dochub

Choosing An Exemption Richmond County Tax Commissioners Ga

Property Tax Exemptions Mhs Lending

Top 9 Georgia Veteran Benefits

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A